Remarks from Amit Bouri at the 2018 GIIN Investors Forum

Below are the opening speech and the closing remarks delivered by Amit Bouri, Chief Executive Officer of the Global Impact Investing Network (GIIN), at the 2018 GIIN Investors Forum on Tuesday, October 30th, in Paris, France. These have been reproduced with permission from the GIIN.

Opening Speech

Good Morning.

A few weeks ago, a group of scientists convened by the UN, issued a landmark report on the effects of global warming. The report presented a disastrous picture of the consequences the world will face if we do not alter our course. Similarly, last month the UN Secretary General sounded the alarm on the UN Sustainable Development Goals. At our current pace, we are moving far too slowly to achieve these targets.

This is an unsettling time in the world. Many of the problems that our society has been grappling with for generations are now coming to a head. Growing inequality and a swelling migrant crisis. A devastating string of natural disasters fueled by climate change. Instability in our democracies and an erosion of trust in our institutions. And the continued oppression of women, further brought to light by the MeToo movement.

We cannot lose sight of the fact that our current financial system exacerbates these issues. Reinforcing inequality and driving decisions that are having a corrosive effect on our world. It’s increasingly clear that our financial system is not working. It’s not serving the planet. It’s not serving the people. And it’s not serving investors.

We need a new way of doing business. We need a financial system that serves everyone. A system that’s accountable for its effects on people and the planet. And I believe that impact investing presents a real alternative to the status quo!

Luckily, there are strong forces in our favor. The turmoil in today’s global community is driving a demand for change. People around the world are more engaged in social and environmental issues than ever before: They are insisting on action. They want to be part of the solution. And this is beginning to translate into their investment decisions.

More and more, people are expecting their investments to reflect their values. And – as the need for impact investing has become clear – investors of all types are choosing to invest more sustainably and more responsibly. In short, there are strong forces calling for change.

But these are not sufficient. Not yet. Incremental progress will not be good enough. Rising to this occasion will require a sharp acceleration in the trajectory of impact investing.

When I think about where this industry is headed, I see that we have reached a fork in the road: One possible path is that, after a surge of interest, impact investing loses momentum. Funding still flows, and we continue to make deals, but growth slows. The approach remains niche or is folded into the status quo—a footnote in the history of the financial markets. In this case, we would still create pockets of impact, but we wouldn’t be generating large-scale change. In other words, the market grows, but we fail.

The other path—the one we need to aim for—is a market transformation. We succeed in creating a better future. One in which all investments account for social and environmental impact. And where impact investing helps to successfully fill the resourcing gap for the SDGs. In this second possibility, we pull the rest of the financial markets along with us, raising the bar for all investments and establishing a new way of doing business.

Now in reality, it’s much more likely that the status quo remains entrenched. Many powerful people, who are winners in the current system, continue to resist change. And it is just easier to maintain business as usual. To remain willfully ignorant of the long-term implications of our decisions.

At this moment, impact investing hangs in the balance. We can’t be sure if it will tip to a new future or be sucked back into business as usual – coopted and absorbed by the status quo. Our only chance for success is to offer a better alternative for the way the world invests.

This is why the GIIN’s vision is bigger than impact investing. This is why we believe in a future where impact is a part of every investment.

Success will require getting to the root of the problems in our financial systems. And then using our influence, our evidence, and our energy to create systemic change. We will need to assume responsibility beyond our own deals and our own portfolios. Because all of our investments around the world can add up to something bigger: To a global economy that is more fair, more sustainable, and more inclusive. Because, ultimately, what does success mean for impact investing if the broader system is failing?

So, how do we do this? How do we build a powerful alternative to the status quo? Three things:

1. We need to mobilize more capital

2. We need to safeguard the integrity of impact investing

3. We need to fuel a global impact investing movement

First, we need to mobilize more capital. We need to bring more investors in to unlock more money for impact investments. We need to engage everyone, from boutique firms to large global institutions. From high-net-worth individuals to retail investors.

Second, we need to safeguard the integrity of impact investing. We need to establish strong values and expectations for impact investors, to ensure that we achieve impact at scale, not just capital at scale. This is essential for game-changing progress on significant challenges, like eradicating world hunger, shrinking social inequities, providing universal access to basic services, and turning back the tide on climate change.

And last, we need to fuel a global impact investing movement. Because ultimately, system change will only come if society demands it. We need to change mindsets about the role of capital in society. And we need to empower every person with the knowledge that their capital can help to build the world they want to live in.

Now, although we are working to transform a system, this change will be driven by people – most notably, every one of you at this Forum. I’ve heard it said that there are 4 things that motivate people to create change: fear, power, love, and hope. And those things are just as relevant for transforming the financial system as any of our technical solutions.

Our fear that the world is heading in the wrong direction will drive us. The power of impact investing will propel us. Our love for humanity and human dignity will strengthen our resolve. And our hope that we can build a new future will inspire us to even greater action!

Whatever motivates you, I hope that each and every one of you views this movement not just as an opportunity, but as a responsibility to lead, to change expectations, and to build a just and sustainable world. Where everyone uses the full power of their investment capital as a force for good!

Thank you.

Closing Remarks

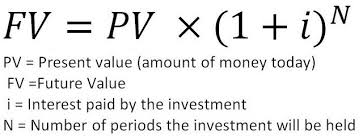

Does this look familiar to you? Raise your hands if you recognize this. It is the formula for the time value of money. A formula based on a fundamental principle of finance that money is more valuable today than it will be to you next year. Why? Because if you have it now, you can invest it. And increase its value.

Now I have my own riff on this principle. And I think it will resonate with this group. Especially following our conversations over the last few days. I call this principle the Time Value of Impact. It follows a similar logic, but the value has influence far beyond your bank account.

The Time Value of Impact is the principle that the impact we create today is much more valuable to the world than if we waited another day or another decade to produce it. It gets at the cost of inaction. The opportunity cost.

If we wait to act, there is of course a monetary cost. For example, every year that we drag our feet on the SDGs, the cost to achieve them continues to grow. But we should also consider the human cost of inaction. When you think about clean energy, affordable housing, accessible insurance for the poor, and access to basic services, such as education and healthcare – failure to act on these issues has a cost at a human level, at a household level, and at a global level. There is a huge difference in waiting a decade.

Ultimately, the Time Value of Impact means that every single one of us, with any amount of investible assets, has more power to create change today than we will tomorrow. So, if you have that power now, it is irresponsible, or as the French Minister said, criminal, not to use it. The cost of inaction is too great. Time matters.

I don’t believe that anyone can leave this Forum without the baseline belief that their investment capital holds powerful potential. As Marilou noted in the opening session, this is the potential to do tremendous good or tremendous harm. No investment is neutral. So now, we all have the awareness. But what we decide to do with this knowledge is a choice. We can look at the obstacles we face and choose to maintain the status quo. Or we can consider the time value of our impact. We can choose to take what we’ve learned and apply it right away. To build a better, brighter, more equitable future—starting today.

The challenges the world faces are very real, very powerful, and very urgent. We cannot achieve the impact that is needed with impact investing as it stands today. But I believe we have a window of opportunity, to set the world on a different trajectory. That is the future of impact investing. And that is the future we are building today.

Related Links: